Emotions rule markets. But it shouldn’t rule wealth management behavior.

Market behavior is naturally emotional because investors are human and react to both positive and negative developments. The old saw—that fear and greed rule the stock market—as as true today as it ever was.

Succeeding as an investor means sticking to your plan and not losing your cool when others are panicking.

Forté is committed to the long view. Our principals have many years of experience and bring that market wisdom to bear in every market environment, up or down. Our role is to dampen emotion, keeping our eye on the long ball, and talk you through market swings so together we stay on course.

Staying steady takes discipline, focus and experience. It’s our ruling principle when emotions challenge strategy and our goal of long-term investment success.

Firmly rooted in reason, asset allocation is the next key to performance.

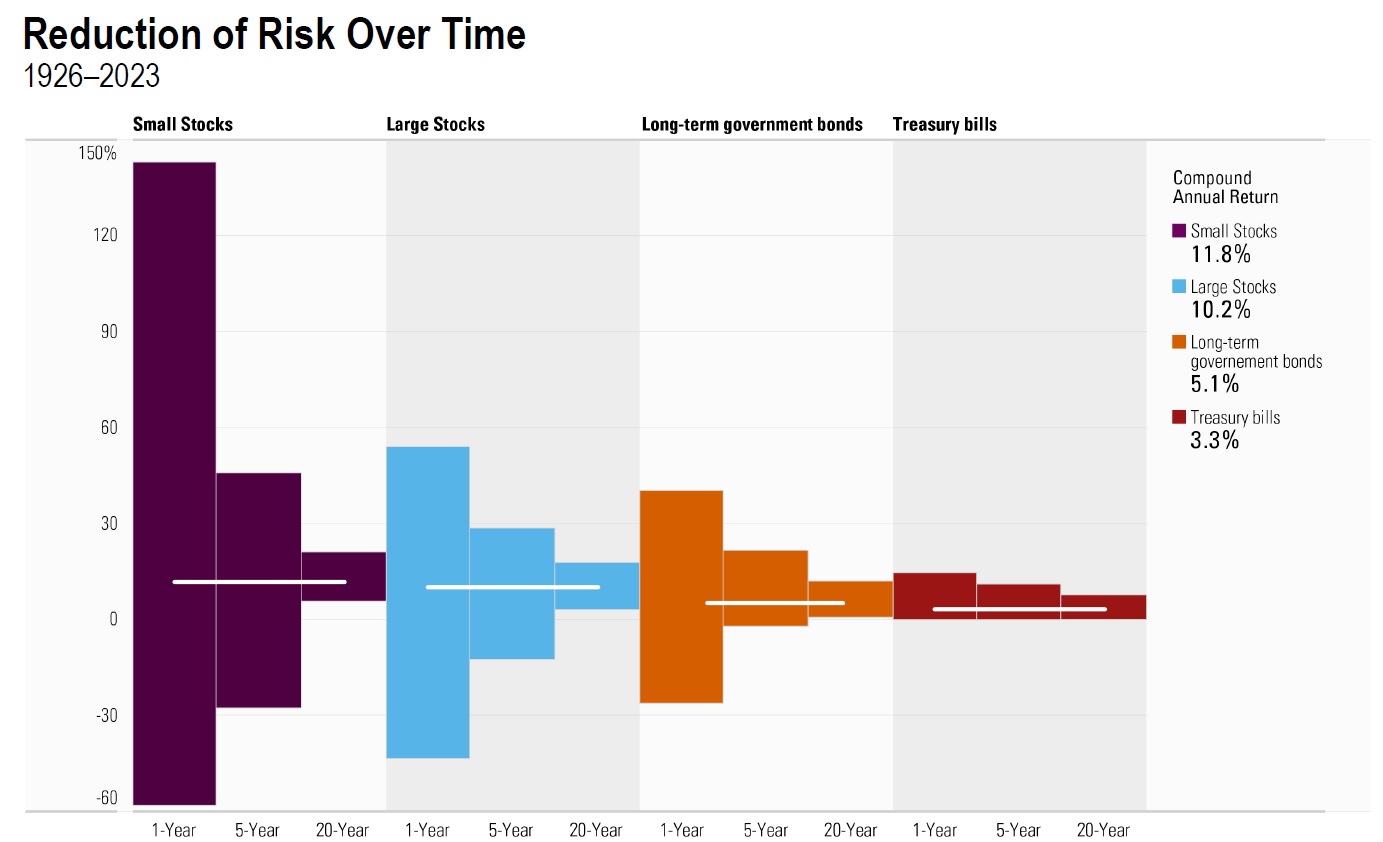

Important Disclosure: Past performance is no guarantee of future results. Each bar shows the range of compound annual returns for each asset class over the 1926-2023 period. This presentation is for informational and illustrative purposes only and is not financial advice or indicative of any investment. . iGrad, LLC is not a financial advisor. If you want financial or other performance advice, then you should consult with a qualified professional.

Source: Morningstar. The reproduction of part or all of this chart with out prior written consent from iGrad, is prohibited. All rights reserved. About the data: Small stocks are represented by the Ibbotson® Small Company Stock Index. Large stocks are represented by the Ibbotson® Large Company Stock Index. Government bonds are represented by the 20-year U.S. Government bond and Treasury bills by the 30-day U.S. Treasury bill. An investment cannot be made directly in an index. The data assumes reinvestment of all income and does not account for taxes or transaction costs.